Corporate Governance [Our Basic Stance]

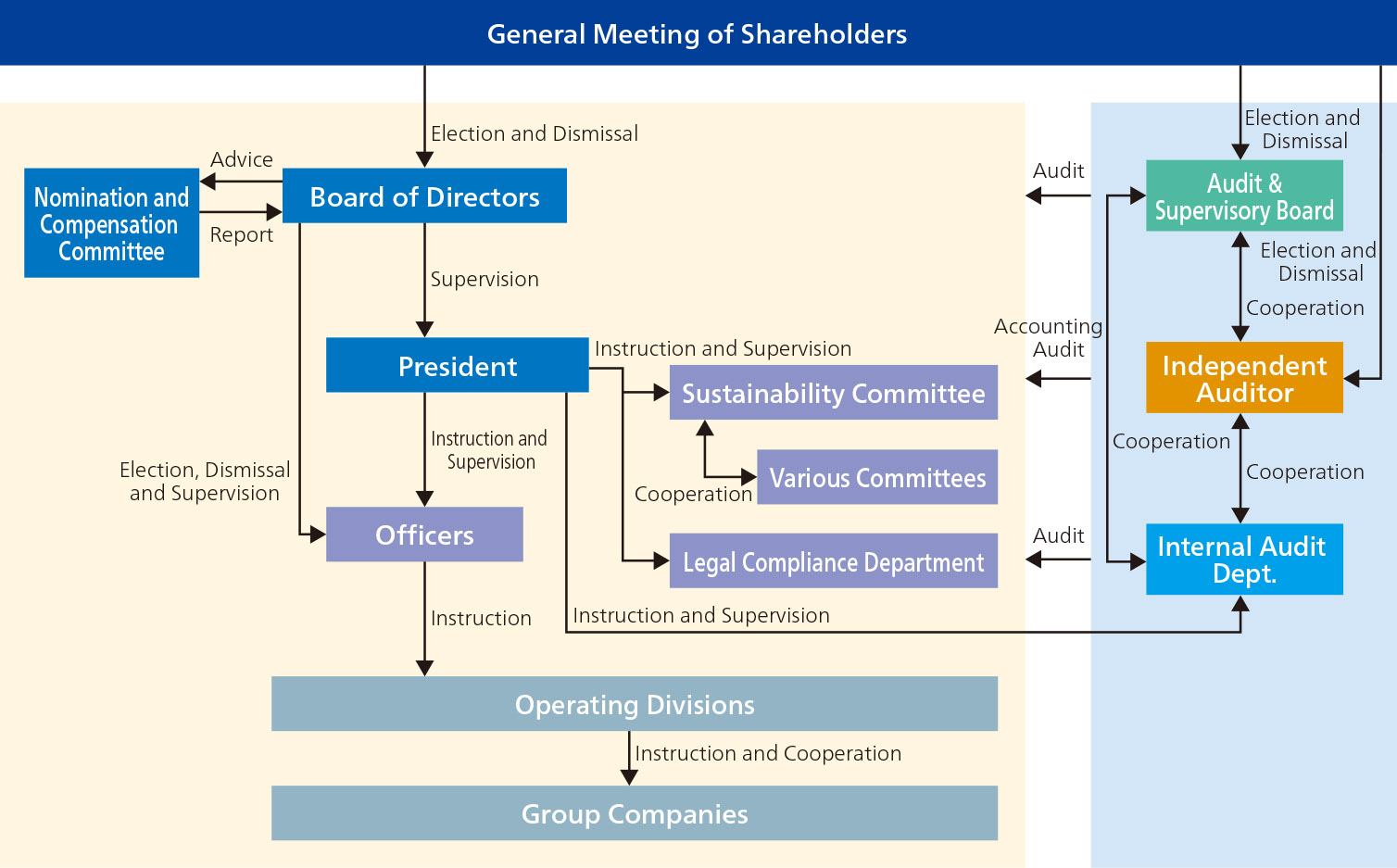

Corporations are required to engage in effective governance that embraces transparency and compliance. Shindengen Electric Manufacturing Co., Ltd.’s basic policy is to maintain and continually improve its management system to enable prompt and precise responses to the rapidly changing operating environment. In addition, by separating management and execution, we allow for the coexistence of rapid decision-making and improved oversight of business execution while enhancing the effectiveness of the internal control system through which the Audit & Supervisory Board conducts independent audits. The management organization of our corporate governance system consists of a group of bodies serving different functions and includes the Board of Directors, the Management Committee, the Audit & Supervisory Board, the Technology- and Quality- Policy Meeting, the General Managers’ Meeting, and the Divisional Directors’ Meeting. These bodies pursue organic Group management through rapid decision-making and efficient business activities. Regarding information disclosure, we continually strive to strengthen IR activities to enhance the fairness and transparency of management.

Corporate Governance System (April 2024)

Compliance with the Corporate Governance Code

To meet the expectations of and build trusting relationships with various stakeholders including customers, shareholders, investors, suppliers, employees, government and administrative agencies, and local communities, Shindengen Electric Manufacturing Co., Ltd. is committed to engaging in appropriate dialogue with stakeholders and providing information disclosures and explanations in accordance with the Corporate Governance Code.

In November 2021, we established a Nomination and Compensation Committee as an advisory body to the Board of Directors. It consists of two outside directors and the Representative Director. The committee considers and debates topics such as director nominations and appropriate compensation and reports to the Board of Directors as required. Furthermore, as a result of a revision in the Tokyo Stock Exchange categories in April 2022, our company moved to the Prime Market. We are working even harder to strengthen our governance structure in light of that.

Status of compliance with each principle of the Corporate Governance Code

See Governance Report

Authority and Role of the Nomination and Compensation Committee

To improve the supervisory functions of the Board of Directors and enhance our corporate governance structure by further establishing the objectivity and transparency of the procedures concerning the nomination and compensation of directors, Shindengen Electric Manufacturing Co., Ltd. established a Nomination and Compensation Committee as a voluntary advisory body to the Board of the Directors. The majority of the Committee is made up of independent outside directors, one of whom also serves as the chairperson.

Officer Compensation

The basic policy behind Shindengen Electric Manufacturing Co., Ltd.’s director compensation is that it should be a compensation system that is linked to shareholder profit so that it can function sufficiently as an incentive to work towards sustained growth in corporate value, and the compensation for each director should be set at an appropriate level that reflects their individual responsibilities. Specifically, compensation for directors (including outside directors) is composed of monetary and non-monetary compensation. Monetary compensation is made up of basic compensation (fixed compensation) and variable compensation (performance-based compensation) that depends on the fiscal year’s performance and medium- to long-term performance. Performance-based compensation is based on a combination of short-, medium-, and long-term indicators and ESG-oriented indicators, and the amount of compensation reflects factors such as position. Non-monetary compensation is defined as compensation in the form of restricted stock, and a portion of compensation is granted as restricted stock in accordance with internal regulations stipulating monthly sum criteria based on position and other factors, within the maximum amount (i.e., within 60 million yen per year) approved at the General Meeting of Shareholders.

Regarding the performance-linked portion of compensation amounts for each individual, the Nomination and Compensation Committee reports the results of its deliberations to the Board of Directors, and after the Board of Directors has deliberated on them, the specific details are delegated to the President and CEO based on the resolution of the Board of Directors.

Assessment of the Effectiveness of the Board of Directors: FY 2023

To improve the functions of the Board of Directors, Shindengen Electric Manufacturing Co., Ltd. analyzes and assesses the board’s effectiveness once a year and discloses a summary of the results. In FY 2023, the Board of Directors’ effectiveness assessment (self-assessment) was carried out using the following analysis and assessment method. A summary of the results is also given below.

1. Analysis and Assessment Process

A survey about the effectiveness of the Board of Directors was administered to six directors (two of whom were outside directors) and three auditors (two of whom were outside auditors). Discussions were held on the results and the assessment was compiled, incorporating the opinions of an outside organization as well.

2. Summary of the Assessment Results

The survey checked the matters the Board of Directors considers important for effectively performing its roles and responsibilities (the constitution and management of the Board of Directors, management strategy and business strategy, etc.), and also checked the involvement of the Board of Directors in issues such as the governance structure the market expects, and issues about sustainability. As a result of the survey, we confirmed from the points below that the company’s Board of Directors is fulfilling its duties and functioning effectively.

•The Board of Directors is effectively operated. The members are aware of their individual responsibilities and hold constructive discussions and exchanges of opinion.

•Improvements were seen in terms of the issues leading up to the previous assessment, including officer training, suitable sharing of risk information, and optimization of the running of the Nomination and Compensation Committee.

However we also confirmed issues that needed further improvement, such as provision of information to outside officers, more vigorous debate based on an awareness of capital costs and capital efficiency, improvements in business execution reports based on monitoring indicators, and officer performance assessments according to their role.

3. Future Response

Based on these results, the Company’s Board of Directors will make continuous improvements and endeavor to improve its effectiveness even further.