Support for the TCFD

In August 2022, Shindengen expressed support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)*1 and joined the Japan TCFD Consortium,*2 which was established as a place to hold discussions among supporting corporations, financial institutions, and other organizations. Going forward, we will move forward with disclosures of climate-related information, as appropriate, while striving to further enhance corporate value and help realize a sustainable society by maintaining eco-friendly business activities.

*1 The TCFD was established by the Financial Stability Board (FSB) and released their final report (the TCFD recommendations) in June 2017.

*2 Established on May 27, 2019, the consortium serves as a venue for discussions on initiatives connecting companies’ effective disclosures and disclosed information to the appropriate investment decisions of financial institutions and other organizations. Japan’s Ministry of Economy, Trade and Industry, Financial Services Agency, and Ministry of the Environment participate as observers.

Climate Change-related Initiatives

The TCFD recommends that companies assess the risks and opportunities brought on by climate change that would affect their business activities and disclose their findings according to the following categories.

The Shindengen Group discloses climate-related initiatives in line with the four disclosure categories of the TCFD recommendations.

TCFD Recommended Disclosure Categories

| Governance | Strategy | Risk Management | Metrics and Targets |

| Disclose the organization’s governance around climate-related risks and opportunities. | Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. | Disclose how the organization identifies, assesses, and manages climate-related risks. | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities. |

Governance

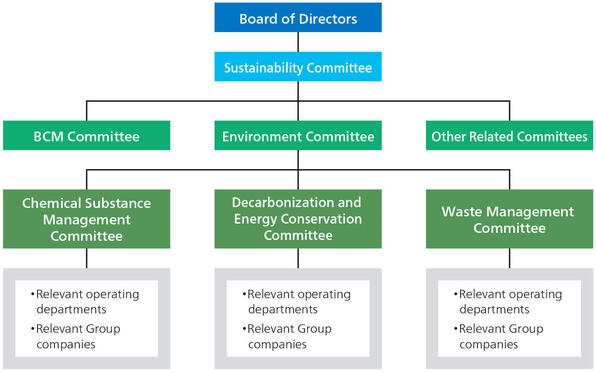

Shindengen Electric Manufacturing Co., Ltd.’s Board of Directors deliberates and decides on matters material to management, including climate-related risks and opportunities in the Shindengen Group. In addition, the Board receives reports on the business execution status of directors and has in place a system that enables appropriate management and oversight.

The BCM Committee confirms the effectiveness of business continuity, including climate change problems.

The Environment Committee is in charge of deliberating environment-related policies, goals, and targets;discussing measures related to protecting the global environment, including climate change problems; and confirming the progress status of measures. We have also established specialized subcommittees under the Environment Committee to investigate and study topics from a specialized position and offer specific proposals.

The activities of these committees are reported where appropriate by the Sustainability Committee, chaired by the President, to the Board of Directors, which continually strives to enhance corporate governance and strengthen sustainability activities.

Strategy

The Shindengen Group stated what we want to become in our Long-Term Vision 2030 as follows: “A power electronics company which creates environmentally friendly cutting-edge solutions via innovative technologies, contributes to a sustainable society, and continues to be needed by all stakeholders.” Along with an awareness of climate change as a serious social issue, we also recognize that it poses risks and opportunities to our business, and we will strengthen initiatives such as activities to reduce CO2 emissions and the expansion of our recycling-oriented businesses on a long-term and ongoing basis.

To reflect climate change countermeasures in our management strategies, we conducted a scenario analysis according to the TCFD recommendations. The scenario analysis makes reference to the below 2°C scenario and 4°C scenario indicated by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).

According to the results of the analysis, in the below 2°C scenario, the push towards a decarbonized society will encourage tighter regulations and technological innovation, the rise in temperature will be limited to a sustainable level, and it is thought that responses to migration risks and opportunities, such as policy shifts, technological innovation, and reputation changes aimed at decarbonization, will be promoted. In the 4°C scenario, no effective measures to reduce CO2 are put in place and the temperature continues to rise, and it is likely that responding to physical risks and opportunities such as intensified abnormal weather will become an issue of utmost importance. In either case, despite concerns about cost increases, the Shindengen Group believes that the base of our business will expand because demand for environmentally friendly products is expected to increase.

Current assumptions regarding major risks, opportunities, countermeasures, and financial impacts are detailed in the following table. The degree of financial impact on business activities is scored as either small, medium, or large.

<Transitory Risks and Opportunities>

| Assumptions | Risks (●) / Opportunities (◎) | Countermeasures | Financial impact |

|

|

Policy |

Each country promotes progressive energy policies, such as promoting xEVs and expanding subsidies |

●The burden of business costs, including for procured energy, increases due to encouragement to use carbon-free and low-carbon energy. ●After the enactment of policies banning the use of internal combustion engine vehicles, related products currently in use become obsolete. ◎With the advance of xEVs, demand increases for various power semiconductors, control units, converters, EV chargers, and more. ◎Demand increases for diodes used in air conditioning and servers and more. |

Strengthen development resources for eco-friendly products. Enhance efficiency of energy used at factories, optimize logistics, and introduce highly efficient equipment that will help further conserve energy. |

Large |

| A carbon tax is introduced. | ●With the introduction of a carbon tax or a rise in the carbon tax rate, costs increase (including renewable energy procurement costs and transport costs due to higher surcharges.) ◎If a carbon tax is introduced, demand for electric vehicles and renewable energy increase. In turn, demand increases for various power semiconductors and highly efficient and energy-saving products for two- and four-wheeled vehicles. |

Make resources more efficient, such as making products smaller and lighter and using more recycled materials. Work to enhance energy efficiency at factories. |

Medium |

|

|

Technology |

Market demand for decarbonization changes and affects product development. |

●Competition to develop energy-related technologies intensifies, and capital investment and R&D costs increase. ●We miss the opportunity to sell current related products due to the acceleration away from engines. ◎There is an increasing shift toward EVs, the introduction of renewable energy, expansion of digital technologies, and more sophisticated controls, such as AI, IoT, and smart cities, leading to an expansion in demand for related products. ◎As society decarbonizes, demand for eco-friendly products increases and leads to business expansion. |

Procure carbon-neutral parts and materials. Enhance ratio of renewable energy used at factories and worksites. Strengthen planning and development of products aimed even lower carbon levels. |

Large |

|

Reputation |

Shift in customer and investor evaluations. |

●Insufficient action on climate change leads to deterioration in profitability and difficulty in procuring funding. ◎Needs for products conscious of environmental burden increases and profit expands. Customer and investor evaluations of Shindengen improve and its corporate value rises. |

Proactively disclose press releases for products that reduce environmental burden and initiatives related to environmental issues, including climate change. Switch the energy used at factories and worksites to renewable energy. |

Small |

Physical Risks and Opportunities Note: These issues will be the most important in the 4°C scenario.

| Assumptions | Risks (●) / Opportunities (◎) |

Countermeasures | Financial impact |

|

|

Acute |

Abnormal weather events grow more extreme, including more frequent storm and flood damage. |

●Profit deteriorates due in part to suspended operations because of storm and flood damage, a decrease in production, the new incurrence of such costs as for restoring equipment and higher insurance rates, and delivery delays caused by supply chain disruptions. ◎Demand expands for products related to generating and storing energy in preparation for storm and flood damage. ◎Demand expands for telecommunications power sources and products related to generating and storing energy in line with needs related to disaster recovery and more active investment in BCP measures. |

Strengthen business continuity plan (BCP) systems across the entire supply chain from parts procurement to production and sales. Take countermeasures and hold drills related to strong winds, heavy rain, and floods. Work to diversify suppliers and transport methods. Work to develop products related to

|

Large |

|

Chronic |

Precipitation patterns change, average temperatures increase, and ocean levels rise. |

●Production capacity falls due to floods or droughts. ●Profit deteriorates due to power outages caused by higher consumption and increased costs, such as for air conditioning, in response to heatwaves. ◎Demand increases in the markets for power generation and storage, xEVs, and air conditioning due to emerging chronic effects of climate change, such as changes in precipitation patterns. |

Strengthen business continuity plan (BCP) systems across the entire supply chain from parts procurement to production and sales. Introduce highly efficient production equipment and in-house power generation facilities. Work to develop products related to generating and storing energy and products that have excellent water and heat resistance. |

Medium |

Risk Management

The Board of Directors and the Environmental Committee manage risks appropriately. They collect wide-ranging information about climate change-related regulations and risk factors that could affect the Shindengen Group’s business operations, and for matters where the risk posed by climate change is expected to become apparent, they assess the impact and draw up measures to minimize the risk.

Furthermore, all business risks, including climate change-related ones, are assessed by the BCM Committee and reported to the Board of Directors as needed. Additionally, we strive as a company to further improve our disaster prevention and our business continuation ability through means such as practical BCP training based on the Business Continuity Plan (BCP) to prepare for situations where it is difficult to continue business normally due to a natural disaster, for example.

Metrics and Targets

The Shindengen Group views its initiatives to protect the global environment as one of its most important management issues. We have therefore formulated the “Environmental Vision 2050” with the aim of promoting activities to realize a sustainable global environment and society from a long-term perspective through the concerted efforts of the entire Group.

The sustainable society the Shindengen Group aspires to is defined as one of “decarbonization”, “arecycling-oriented society”, and “a society in harmony with nature”, and we focus on this ideal not only in the Shindengen Group's business activities, but throughout our entire value chain, aiming to minimize our environmental burden by the year 2050. We have also established the FY 2030 Environmental Targets as a guidepost towards Environmental Vision 2050, and we will accelerate our environmental contributions by practicing the SDGs Materiality Targets identified by the Shindengen Group.

Initiatives for the Science Based Targets initiative (SBTi)

Status of Obtaining SBT Certification

Shindengen Electric Manufacturing Co., Ltd. began SBT-focused initiatives in September 2021. We recognized the importance of Scope 3 calculations for obtaining SBT certification, and we established a calculation method with the support of experts after collecting the basic information for calculating Scope

3. We obtained SBT certification in October 2023 and published the fact in a news release on Shindengen'scorporate website.

The SBT certification application states the following CO2 emission reduction targets for the Shindengen Group in Japan and overseas.

FY 2030 Medium-Term Targets

•Scope 1, 2: A 42% reduction by the end of FY 2030, using FY 2021 as the base year

•Scope 3: A 25% reduction in Category 11 emissions by the end of FY 2030, using FY 2021 as the base year