Strategy

Our Basic Strategy

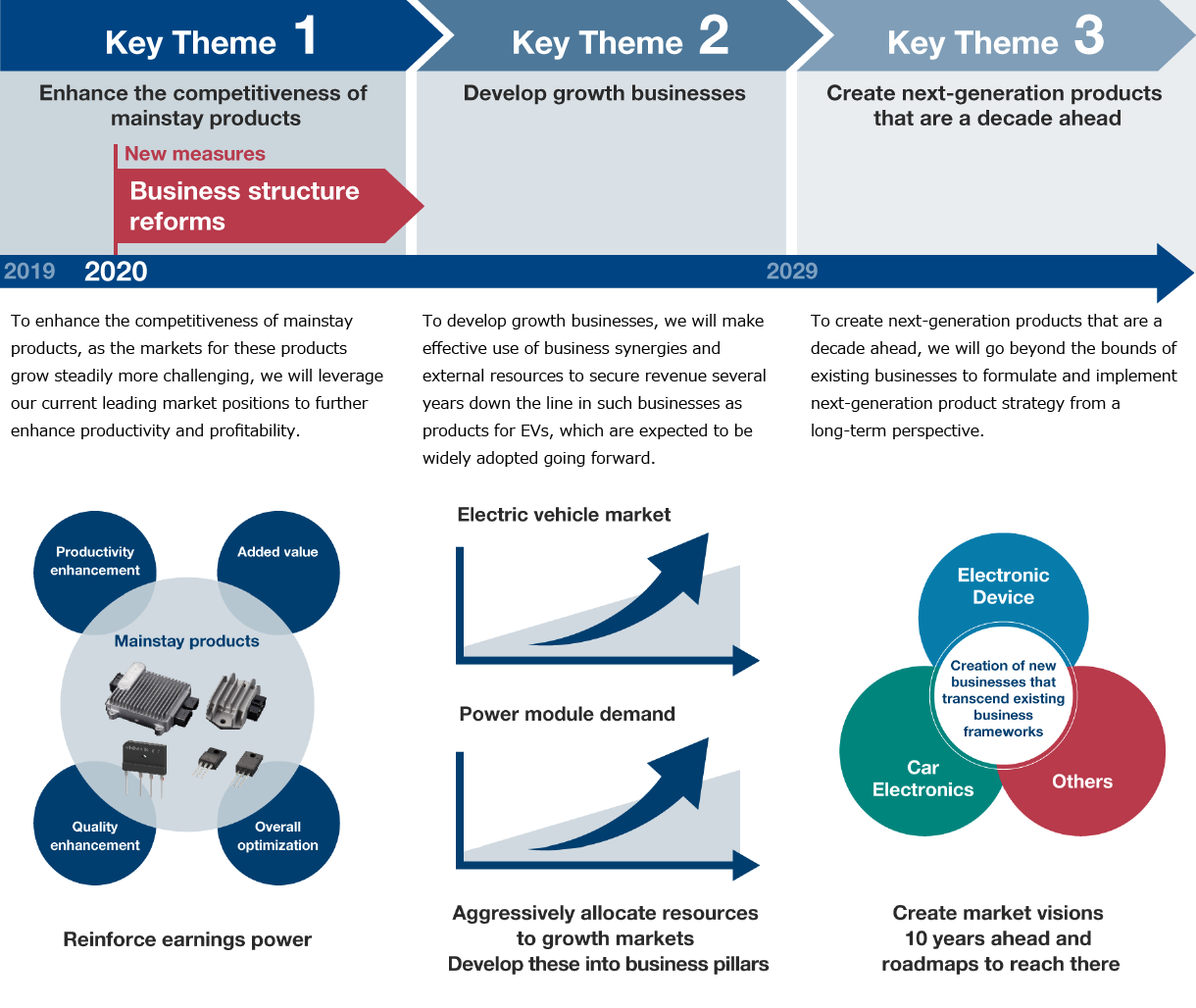

The Shindengen Group launched its 15th Medium Term Business Plan in fiscal 2019 with the basic policy of “Advancing product strategy for sustainable growth” as a framework for the three years leading to fiscal 2021 and beyond. In particular, we have positioned mobility as a key market, in which we expect demand expansion related to vehicle electrification and tightening environmental regulations, and are focusing efforts on business in this area.

However, the prolonged trade friction between the United States and China led to a slowdown in the semiconductor business. In addition, the global COVID-19 pandemic led to widespread restrictions on activities, including efforts to stay home and lockdowns, which worsened the business environment for mobility-related businesses, particularly in Southeast Asia. These factors led to a sharp decline in earnings. Given this environment, Shindengen implemented business structure reforms, described below, with the aim of building a revenue structure that will be resilient to changes in the market environment and a robust management foundation.

Business Structure Reforms

1. Business Structure Reform Goals

We are building a revenue structure that is resilient to changes in the market environment and reinforcing competitiveness primarily in mobility and industrial machinery, which we have designated as key markets, in order to increase corporate value.

2. Business Structure Reform Measures

(1) Reorganizing the development framework

To rationalize and improve the efficiency of development, we have transferred the development functions of the Hanno Factory to the Asaka Office, opened in April 2021, as well as to domestic Group companies. By bringing together the R&D and business operation functions of the Hanno Office with the management functions of the Otemachi Head Office at the Asaka Office, which offers a cutting-edge ICT environment, we will improve productivity. As part of these reforms, we decommissioned the clean room at the Hanno factory in March 2021. With these changes, the R&D and business operation functions of the Hanno Factory have come to an end.

(2) Revising production systems

In the Electronic Device segment, some of the power module production lines of Akita Shindengen have been replaced by high-productivity lines that incorporate IoT at Lumphun Shindengen (Thailand), realizing rationalization and productivity improvement. Going forward, Akita Shindengen will build production lines for next-generation power modules, aiming for further growth in power modules for the mobility and industrial machinery markets.

Higashine Shindengen will close one of its clean rooms in fiscal 2022, improving the utilization of front-end processing facilities by approximately 20%. Combined with the aforementioned closing of the Hanno Factory clean room, Shindengen will thus reduce its domestic clean rooms from five to three. Though these changes and a shift to larger semiconductor wafer sizes at Akita Shindengen and Higashine Shindengen, we plan to improve front-end processing productivity by approximately 30%.

-

In the Car Electronics segment, to reinforce competitiveness in the mobility market, we aim to rationalize and improve the efficiency of production. We are moving production of some products from Japan to overseas factories and revising our production systems in Thailand, Vietnam, Indonesia, India and China, promoting optimization in each product category. Furthermore, in Japan we are advancing automation and labor-saving measures, mainly for four-wheel vehicle products, such as DC/DC converters for eco-friendly vehicles.

(3) Rationalizing unprofitable products

We are phasing out production of unprofitable power conditioners for photovoltaic generation.

In semiconductors and other businesses, we are speeding up revisions of our product portfolio to rationalize low-profit products and improve overall profitability.

(4) Adjusting staffing levels

In fiscal 2020, we solicited voluntary retirement and took other measures that resulted in an 11% reduction in personnel at the domestic Group. By doing so, we adjusted staffing levels to better fit our business scale.

We expect these structural reforms to yield results beginning in fiscal 2021.

3. Structural Reform Costs and Effects

The suspension of R&D and business operation functions at the Hanno Factory resulted in an impairment loss. Combined with other structural reform costs, including those for reorganizing the development framework, revising production systems and adjusting staffing levels, the cost of structural reforms amounted to approximately ¥3.9 billion in extraordinary losses at the end of the fiscal 2020.

These business structure reforms are expected to increase profit in fiscal 2021 by approximately ¥3.6 billion.